Credit Repair

Repair Bad Credit

Public Records

Collection Agencies

A judgment on your credit report can be devastating to you credit scores. Judgments (child support, civil & small claims) remain on your report for 7 years from the date the judgment is filed.

Read my story below (and check out the images for proof) to see how you can remove a bankruptcy from your credit report.

Like many other Americans, when the economy tanked my husband's employer let go of half of its employees, including my husband. We were able to keep up on the bills with his unemployment check and my part time job but, eventually the checks ran out and the monthly payments proved to be too much.

To save our house, we ended up filing bankruptcy. In hindsight, it may not have been the best decision, but we did what we had to do to keep a roof over my family. The bankruptcy relieved us of our debt, but the damage to our credit was done as we ended up with judgments, charge offs and collections on our credit report.

The next couple years were pretty miserable. We couldn't get a loan for anything. Even though my husband was able to find a great job and put some money away in savings we were denied every single time we applied for anything. The banks told us that our credit scores were too low and that there was nothing they could do for us. It was frustrating and embarrassing.

A friend told us about Lexington Law and how they could permanently remove negative items from your credit report by disputing them with the credit bureaus. It sounded awesome to me! But, was it true? We trusted our friend, but we thought to ourselves, "how can this be possible?"

After taking our friend's advice and calling (800) 215-9365 I spoke to a friendly credit expert. She understood our situation and was also very knowledgeable. So, we signed up and received the $50 discount for couples.

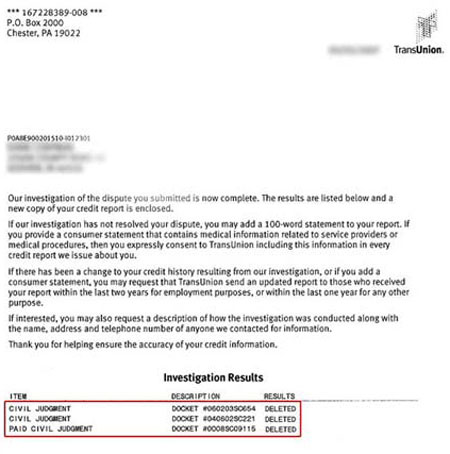

It turned out to be one of the best decisions we have ever made! After about 3 weeks, we started receiving letters (like the one below) stating that negative accounts had been removed from our credit reports!

Here's one of the letters we received from TransUnion letting us know that the investigation was complete and that 3 of the 3 judgments disputed had been DELETED! This is just one of many letters we continued to receive in the mail over the next 6 months.†

I can't even begin to tell you how thankful I am that I found Lexington Law. I was finally able to purchase my first home and my financial life has been secure ever since. With the negative accounts off of my credit report, my credit scores have improved significantly. Here's a picture of my credit scores:

If we had signed up sooner, we would have saved ourselves a lot of embarrassment and heartache, but we're just grateful we did. The truth is, most people don't know about credit repair and think they have to wait 7-10 years to get a loan.

You don't have to wait that long! Call (800) 215-9365 right now for a free credit consultation!