Credit Repair

Repair Bad Credit

Public Records

Collection Agencies

A bankruptcy can remain on your credit report for 10 years and be devastating to your credit scores. However, contrary to popular belief, you can still get credit after bankruptcy. You do NOT have to wait up to 10 years before being able to get a mortgage, car loan or any other type of credit again.

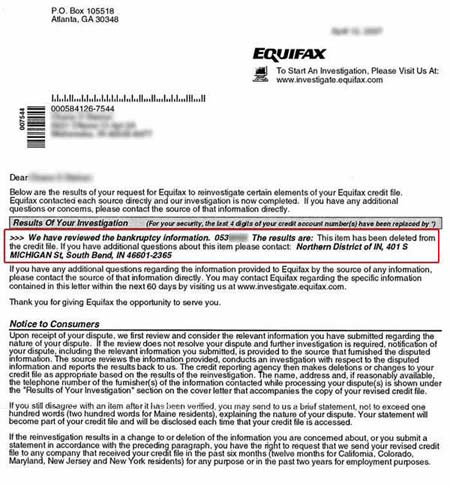

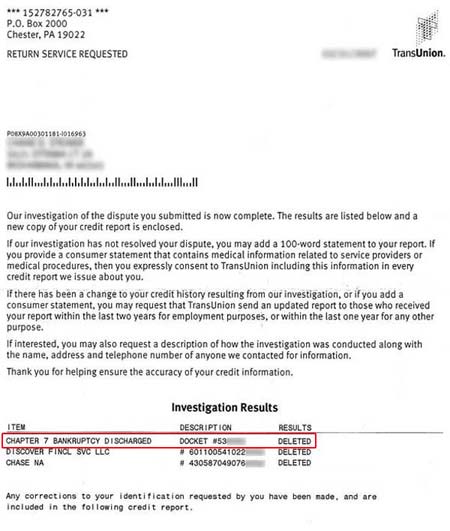

Read my story below (and check out the images for proof) to see how you can remove a bankruptcy from your credit report.

Like many other Americans, when the economy tanked my husband's employer let go of half of its employees, including my husband. We were able to keep up on the bills with his unemployment check and my part time job but, eventually the checks ran out and the monthly payments proved to be too much.

To save our house, we ended up filing bankruptcy. In hindsight, it may not have been the best decision, but we did what we had to do to keep a roof over my family. The bankruptcy relieved us of our debt, but the damage to our credit was done.

It's not what happens to you, but how you react to it that matters. - Epictetus

I knew I had to do something about my credit. I wasn't just going to sit there and wait for 7 to 10 years until the bad credit fell off of my report. I tried to apply for new loans to show them that I was credit worthy, but every single bank denied me. Getting turned down for loans over and over was frustrating and embarrassing.

A friend told me about Lexington Law and was ranting and raving about how awesome they were. I was skeptical at first, but after seeing what they did for him, I knew I had to give them a try./p>

I gave them a call and talked to a credit expert from Lexington Law who was very friendly and understanding of my situation. She was also very knowledgeable. So, I went ahead and signed up. Boy, am I glad I Did! After about 3 weeks, I started receiving letters from the credit bureaus stating that negative accounts had been removed from my credit reports!

I can't even begin to tell you how thankful I am that I found Lexington Law. With the negative accounts off of my credit report, my credit scores have improved significantly. Here's a picture of my credit scores:

If we had signed up sooner, we would have saved ourselves a lot of embarrassment and heartache, but we're just grateful we did. The truth is, most people don't know about credit repair and think they have to wait 7-10 years to get a loan.†

You don't have to wait that long! Call (800) 215-9365 right now for a free credit consultation!